End of Year Edition – Despite the Odds, Global R&D Spending Grew Again in 2024, Inching Closer to the USD 3 Trillion Mark

23 de dezembro de 2025

As many economies navigate an uneven recovery, R&D data tells an uplifting story: global R&D spending is still rising, edging closer to the USD 3 trillion mark, and more middle-income economies are building R&D systems at impressive speeds. Another takeaway is that the world is maintaining a historically high R&D effort—close to 2% of GDP; the world economy is far more research-intensive than a decade or two ago.

To close out 2025 on an inspiring note, the Global Innovation Index (GII) team is happy to provide you with nine fresh, stylized fresh facts on global R&D.

Global R&D trends – How have global R&D levels evolved?

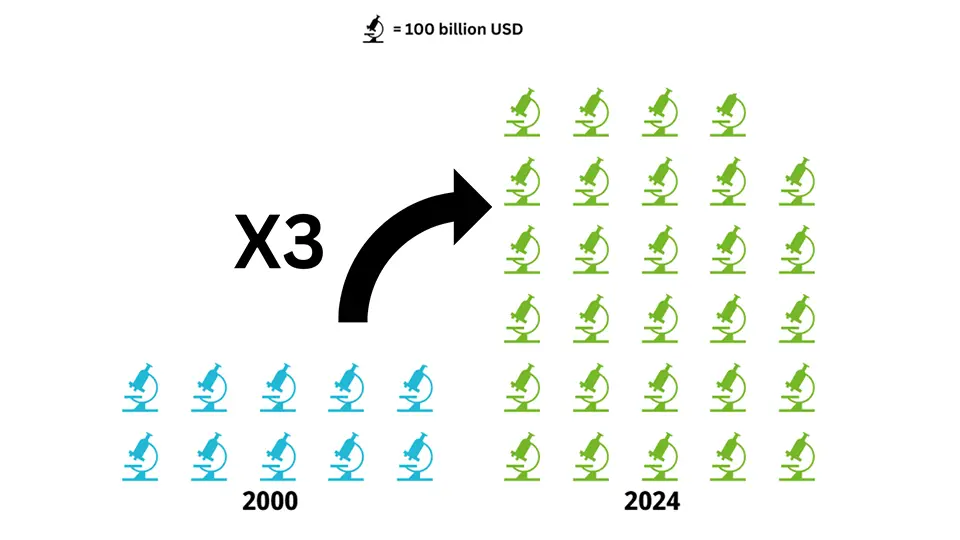

Stylized Fact 1: Global R&D continues to expand in 2024—edging closer to 3 trillion (2015 PPP) and more than tripling in real terms since 2000

World R&D expenditure haven risen to USD 2.87 trillion in 2024, up from USD 2.78 trillion in 2023 according to our estimates, up by close to 3% year-on-year and close to tripling in real terms relative to 25 years ago (see Figure 1 and 2, all in constant 2015 PPP terms).

Figure 1: Global R&D, in USD trillion, 2000 VS 2024

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)

Stylized Fact 2: The Global Economy is More and More R&D-Intensive

World R&D intensity (R&D as a share of GDP) has significantly increased from 1.48% in 2000, from 1.6 % in 2010 to about 2% in 2024 (see Figure 2). Year-on-year and compared to 2023, R&D intensity is however rather stable (around 1.99% in 2023).

Figure 2: Global R&D Growth, in USD trillion and as % of GDP

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)

Stylized Fact 3: The Global R&D Landscape Keeps on Shifting Toward Asia and – a little – towards Africa

Asia’s structural ascent in global R&D continues. Asia now accounts for about 45% of global R&D in 2024, reflecting a pronounced increase from around 23% in 2000. In 2024, the Southeast Asia, East Asia, and Oceania (SEAO) region emerged as the largest R&D-spending region, accounting for about 42% of global R&D. This region includes China, Japan, the Republic of Korea, and Southeast Asian economies like Indonesia and Thailand; only Japan is trending down over time (see Figure 3).

Figure 3: Regional shares of global R&D, in %, by region

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information). SSA refers to Sub-Saharan Africa, NAWA to Norther African and Western Asia, LAC to Latin America and the Caribbean, SEAO to Southeast Asia, East Asia, and Oceania, and CSA to Central and Southern Asia

Across Southeast Asia, several ASEAN members have emerged as some of the fastest-growing R&D investors. As shown in Figure 4, economies like Indonesia and Viet Nam have posted strong upward trajectories in GERD between 2018 and 2024. Singapore, already an advanced R&D performer, continues to expand its investment at rates comparable to other leading high-income economies. Meanwhile, the Philippines and Thailand show more moderate but steady progress, underscoring a region-wide effort to strengthen innovation and research capacity.

Figure 4: R&D trends in selected ASEAN economies, 2018-2024

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)

In turn, Northern America (the United States and Canada), the global regional R&D leader from 2000 to 2010, now holds around 28% of global R&D, followed by Europe (around 20%) and Central and Southern Asia (3.25%), which includes a rising India.

Latin America and the Caribbean (LAC), in turn, have seen their share decline from 3% in 2000 to less than 2% in 2024. In Latin America, Brazil, the region’s largest contributor, saw its share fall from 2% in 2000 to 1.3% in 2024. Argentina and Mexico also experienced declines. For a complete picture of all economies, please see Annex Table 1 in the Background section.

Northern Africa and Western Asia (NAWA) have increased their shares, moving from less than 2% in 2000 to slightly more than 4% in 2024, whereas Sub-Saharan Africa (SSA) has also increased its global share – amid low levels, doubling it from as mere as 0.27 % in 2000 to 0.56 % in 2024. In Northern Africa, Egypt stands out with an impressive increase, rising from 0.1 % of global R&D in 2000 to 0.6 % in 2024, a success story to watch closely. In terms of absolute R&D spending in African economies, Egypt also stands out as a clear leader in Africa, with R&D spending experiencing a significant surge since 2007 – reaching over 16 billion USD (PPP-adjusted 2015 prices) in 2024. Algeria, Morocco, Tunisia and Nigeria also recorded strong gains since 2020 based on our – albeit imperfect - estimates (see Figure 5).

Figure 5: R&D trends in selected African Economies, 2020-2024

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information). This chart includes all African economies classified under the UN regions of Northern Africa and Western Asia (NAWA), as well as Sub-Saharan Africa (SSA).

Stylized Fact 4: On a country-level, the global distribution of R&D has shifted in important ways since 2000; some established innovation leaders are experiencing relative declines

Another striking long-term shift emerges from the data on changes in global R&D shares between 2000 and 2024 (see Figure 6). China stands out as the largest gainer by a wide margin, increasing its share of world R&D by more than 23 %age points, an unprecedented rise in recent innovation statistics. But China is not alone: a group of dynamic economies—including the Republic of Korea, Türkiye, India, Egypt, Thailand, Poland, and Saudi Arabia—also expanded their global R&D footprint.

In contrast, several innovation powerhouses saw notable relative share declines. The United States and Japan experienced the steepest drops, losing 9.7 and 7.2 %age points respectively, followed by reductions in Germany, France, Italy, Canada, the Russian Federation, Brazil, and the United Kingdom.

Figure 6: Top Gainers and Losers in Global R&D Share, 2000–2024

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)

Global R&D trends – Who are the 15 top R&D spenders worldwide?

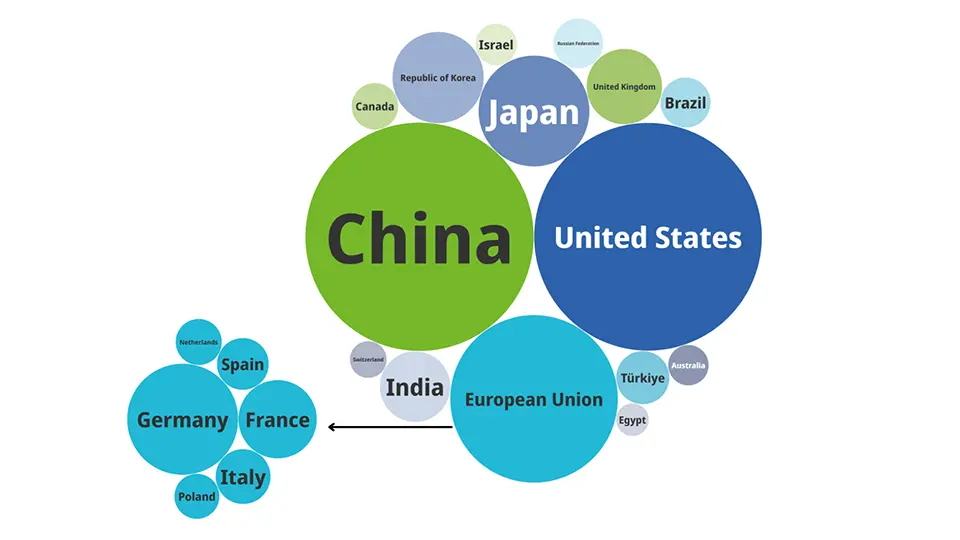

Stylized Fact 5: China and the United States Lead Global R&D Spending

In 2024, the world’s two largest R&D spenders are estimated to be China (USD 785.9 billion) and the United States (USD 781.8 billion) in comparable 2015 PPP terms. This near‑tie between China and the United States - is a new milestone (see Figure 7).

The gap between these two leaders and the rest remains substantial and has indeed increased as compared to our analysis last year. Japan ranks third with about USD 186 billion (around 24 % of China's spending), followed by Germany with USD 132.2 billion (17 % of China's), the Republic of Korea (16 % of China's), the UK at USD 86.5 billion (about 11 % of China's), and India with an estimated USD 76 billion (about 10 % of China's). When grouped as a single entity, the European Union (EU)'s total R&D expenditure is a little over one half that of the United States and China, at approximately USD 424 billion (See Figure 7).

Alongside long‑standing leaders such as Japan, Germany and the Republic of Korea, the top 15 includes India (USD 75.7 billion), Türkiye (USD 43.2 billion) and Brazil (USD 38.4 billion), as well as smaller high‑intensity economies such as Israel.

Figure 7: Top 15 Global R&D Spenders, 2024, in USD 2015 PPP

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information).

The top 15 global R&D-spending economies now include several middle-income nations, notably China, India, Türkiye, Brazil, and the Russian Federation. If the EU is treated as a single entity in the top 15, Egypt makes this group (see Table 1). In the EU, the top R&D spenders in 2024 are Germany (132 billion USD), France (66 billion USD), Italy (32 billion USD), Spain (29 billion USD) and the Netherlands (23 billion USD).

Table 1: Top 15 Global R&D Spenders, 2024, in USD 2015 PPP

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)

Global R&D trends – Which economies have seen the fastest R&D spending growth over the last two decades?

Stylized Fact 6: Since 2000, Middle-Income Economies Dominate Fastest-Growing R&D Spending

As a corollary to fact 5, the list of the fastest-growing R&D spenders is almost exclusively composed of middle-income economies, with the notable exception of Saudi Arabia, Malta and Cyprus.

- China’s R&D spending rose from USD 40.7 billion in 2000 to USD 785.9 billion in 2024—an almost 20‑fold increase.

- Türkiye expanded from USD 4.5 billion to USD 43.2 billion, while Malaysia scaled up from USD 1.8 billion to USD 10.2 billion.

- Indonesia’s spending increased more than 12 times, reaching USD 10.6 billion in 2024.

- India more than tripled, from USD 20.8 billion to USD 75.7 billion, if our estimates are correct.

Figure 8: Middle‑income economies with the fastest R&D spending growth, 2000–2024

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)

Stylized Fact 7: Some high‑income economies are also posting strong growth as they diversify and scale R&D capacity

While growth in many high‑income economies is more moderate in relative terms, several economies have accelerated investment in recent years (see Figure 9).

The United States roughly doubled its expenditure over the 24-year period (from USD 359.4 billion to USD 781.8 billion), and Germany expanded its spending from USD 79.8 billion to USD 132.2 billion. These are sizeable increases, but far smaller in relative terms than those observed across many emerging economies.

R&D expenditure has increased steadily across both the Baltic states and Eastern Europe since 2000, albeit from relatively low starting points and along distinct paths. In the Baltics, Estonia expanded its R&D expenditure by roughly six times, while Lithuania and Latvia recorded growth on the order of four times between 2000 and 2024.

Across Eastern Europe, growth has been more uneven but, in several cases, larger in scale. Poland stands out clearly, with R&D expenditure increasing by around sixfold since 2000, reaching more than USD 20 billion (2015 PPP) in 2024. Other countries in the region—notably the Czech Republic, Hungary, and Romania—also expanded their R&D spending by three times over the period.

In the Middle East, diversification strategies are visible in rising R&D budgets. High-income economies Saudi Arabia and the United Arab Emirates, although lacking complete data for the early 2000s, both have R&D expenditures estimated to exceed USD 10 billion in 2024. Oman, while operating at a much smaller scale, also shows a gradual upward trend in R&D spending, increasing from negligible recorded levels in the mid-2010s to an estimated USD 0.65 billion in 2024—a near doubling since 2019.

Figure 9: High‑income economies with the fastest R&D spending growth, 2000–2024

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)

Global R&D trends – Which are the most R&D‑intensive economies?

Stylized Fact 8: R&D intensity varies largely across economies in 2024—from over 6% of GDP in top performers to well below 1% in much of the world

R&D intensity varies widely across economies in 2024 (see Figure 10). Israel leads with R&D at 6.33% of GDP, followed by the Republic of Korea at 5.32%. A second cluster of high-income economies in terms of intensity includes Japan and the United States (both at 3.45%), Belgium (3.32%), and Germany (3.11%), all maintaining elevated commitments to research.

China, an upper-middle-income economy, continues to close the gap with an intensity of 2.65 %.

Among upper‑middle‑income economies, by our estimates, several have moved above the 1% threshold, including Türkiye (1.42%), Thailand (1.16%) and Brazil (1.15%). By contrast, R&D intensity remains below 0.5 % in large parts of middle-income economies, including Viet Nam (0.42%), the Philippines (0.32%), Indonesia (0.28%), and Ethiopia (0.27%), in part possibly reflecting outdated data.

Many economies— roughly 72% of world economies—maintain R&D to GDP ratios below 1% and roughly 53% of world economies maintain ratios of below 0.5%.

Figure 10: R&D intensity for selected economies, 2024

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)

Global R&D trends – Which are the economies in which the private sector drives R&D?

Stylized Fact 9: In many leading R&D economies, the private sector finances most R&D - often more than 70–90%

In many economies, business accounts for an overwhelming share of total R&D (see Figure 11): Israel leads with 93% financed by the private sector, followed closely by Viet Nam (90.5%) and Ireland (86.1%). Major innovation leaders show similarly high levels of private sector involvement, including the Republic of Korea (79.2%), Japan (79.1%), the United States (78.4%), and China (77.7%). In Sweden, Germany, and Switzerland, private funding contributes roughly two-thirds to three-quarters of total R&D spent.

Figure 11: The share of private financing in total economy‑wide R&D, 2024

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)

By contrast, in many middle-income economies, public investment continues to play a dominant role. Countries such as India, South Africa, Mexico, Kenya, and Egypt all show private sector shares below 40 %.

In sum, in many middle- and low-income economies, public investment remains central to building foundational capacity, yet, it is policies that encourage private R&D, and collaboration which will help sustain long‑term innovation-driven growth in the future.

Background

To the surprise of many, reliable and up-to-date data on R&D—often considered a fundamental innovation indicator—is not readily available for all economies, let alone for recent years like 2024.

To address this gap, the WIPO GII team works to provide a comprehensive global view of innovation and inform country rankings by leveraging data and estimates from esteemed institutions such as Eurostat, the Ibero-American and Inter-American Network of Science and Technology Indicators (RICYT), the New Partnership for Africa's Development (NEPAD) Agency, the African Union, the Organization for Economic Co-operation and Development (OECD), and the UNESCO Institute for Statistics (UIS).

We extend our sincere gratitude to the following colleagues: UNESCO Institute for Statistics (UIS): Rohan Pathirage and José Pessoa, OECD: Fernando Galindo-Rueda and Fabien Verger, RICYT: Rodolfo Barrere and Laura Trama, and African Union Development Agency-NEPAD: Lukovi Seke.

On methods: R&D investment captures R&D expenditures worldwide in PPP-adjusted constant 2015 prices. The 2023 values were calculated using available real data of gross expenditure on R&D (GERD) and business enterprise expenditure on R&D (BERD) at the country level. For those countries for which data were unavailable for 2023 and 2024, the data were estimated using the last observation carried forward (LOCF) method for R&D intensities (R&D expenditures as a % of GDP) and applied to GDP PPP for the same year, using GDP growth at constant prices from the International Monetary Fund, World Economic Outlook Database, October 2025 edition.

The GII itself incorporates R&D data across various dimensions, using a total of three indicators. For example, the GII Economy Profiles available in the GII Innovation Ecosystems & Data Explorer highlight specific official R&D statistics such as:

- 2.3.2: Gross expenditure on R&D (GERD) as a % of GDP

- 5.1.3: GERD performed by business, as a % of GDP

- 5.1.4: GERD financed by business, as a % of GDP

Annex Table 1: World’s R&D Share in 2000 vs 2024

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)

Annex Table 2: Economies by R&D Growth (CAGR), 2000-2024

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)

Annex Table 3: Global Ranking of Economies by R&D intensity (GERD as a % of GDP), 2024

Source: WIPO estimates based on GII Database and data from Eurostat, OECD, RICYT, and UNESCO UIS (see background information)