Technological developments and trends

The economic toll of disasters has risen sharply over the past century. Low-income countries have borne the heaviest relative burden, averaging losses exceeding 2 percent of GDP annually in recent decades – over twice the share of GDP compared to wealthy nations. As shown in figure 11.1, high-income countries that face absolute economic losses generally sustain lower relative damages that are typically below 0.5 percent of GDP (

High-income countries face the highest relative losses due to wildfires, most likely due to suburban sprawl

When considering economic damages by disaster type, the differences come into sharper relief. For example, figure 11.2 shows economic damage from drought, depicting low-income countries as impacted the most profoundly. Figure 11.3, on the other hand, shows economic damage from wildfire events (

As climate change intensifies hazards, the need for robust and tailored risk transfer mechanisms becomes critical for the mitigation of financial shocks. This is especially true for low-income countries, since traditional insurance often fails to reach the most vulnerable. Financial and insurance technologies are revolutionizing risk management, while bolstering resilience for both disaster victims and even the insurance companies themselves (

Mobile money platforms enable direct cash transfers to be made to vulnerable populations, while cryptocurrency donations bypass traditional banking barriers for cross-border aid. Indexed-based insurances using satellite data and catastrophe bonds use big data and AI to protect farmers and governments from climate shocks. Digital cash and voucher assistance (CVA) programs now integrate biometrics and blockchain to reduce fraud. The World Bank and private insurers are adopting AI-powered risk models to streamline catastrophe bond issuance, attracting capital markets to disaster recovery. Yet challenges remain, such as ensuring equitable access, safeguarding data privacy in biometric verification systems, and protecting the three billion people still underserved by microinsurance (

Digital cash can make disaster aid smarter, faster and safer

Cash and voucher assistance (CVA) is a humanitarian aid approach whereby those affected by crises receive cash or vouchers instead of direct goods or services. Cash assistance means giving beneficiaries money (physical or digital) that they can spend as needed. Voucher assistance provides beneficiaries with coupons or electronic vouchers that can be exchanged for specific goods or services from approved vendors. As humanitarian aid shifts from in-kind to cash-based assistance, digital cash is replacing traditional cash delivery due to its agility, transparency and cost-effectiveness. It empowers recipients with greater choice, supports local markets, improves speed and flexibility, enhances accountability, promotes financial inclusion, and reduces personal risks associated with carrying physical cash or in-person transactions.

Financial and insurance technologies are revolutionizing risk management, while bolstering resilience for both disaster victims and even insurance companies

Mobile money solutions like M-Pesa (Kenya), bKash (Bangladesh) and GCash (Philippines) are essential tools for disaster relief. This is especially the case in areas with limited banking infrastructure, enabling the direct transfer of funds to individuals via their mobile phones. bKash, for example, operates through SMS and unstructured supplementary service data (USSD) codes, enabling users without smartphones or internet access to perform transactions. With strong security protocols and integration with mobile and agent networks, these platforms ensure reliable access to financial services, especially in emergency situations.

Using predictive analytics, preemptive cash transfers can be issued in advance of disasters, while mobile money systems enable instant aid disbursement, even in low-connectivity areas. Meanwhile, blockchain and biometrics are streamlining CVA to reduce fraud. Blockchain technology can support disaster response by providing secure, transparent and decentralized methods for managing identities and aid distribution. In emergency situations where displaced individuals often lose physical documents, blockchain enables fast and verifiable ID management (

Biometric technology (also discussed below), including fingerprints, iris scans and facial recognition, is used alongside mobile and blockchain technologies in CVAs. It is seen as a tool to enhance accountability, prevent fraud and ensure aid reaches the intended individuals. However, the political context of each country and the unequal implementation of biometric-based CVAs can create challenges, hindering efforts to promote independence and dignity, especially when biometric data is either not recognized or restricted (

Forecast-based/anticipatory cash assistance. Ahead of Cyclone Remal’s expected landfall in Bangladesh’s southern coastal regions in 2024, the WFP promptly distributed cash assistance of USD 43 (BDT 5,000) to 30,000 vulnerable families across five districts, helping them prepare for and recover from the storm (

Insurance solutions that bridge gaps in climate risk coverage gaining traction

Insurance plays a vital role in mitigating climate risks by transferring financial burdens from vulnerable individuals and communities to broader markets (

Disaster insurance faces significant adoption challenges, especially in low-income countries. Market failures stem from high risk, limited financial capacity, poor risk data, as well as behavioral factors like “charity hazard” (reliance on post-disaster aid) (

Collaboration, especially public–private partnerships, is key to improving disaster insurance by addressing market gaps, tailoring products to local needs, and boosting resilience using innovative schemes. Understanding risk impacts on the willingness to pay for insurance alongside specific risk characteristics also helps inform better insurance strategies. In addition, policy and governance are key to disaster insurance uptake, but many developing countries have reactive, weak frameworks. Success requires political will, strong laws, stakeholder coordination and government/donor support in data, legal setup and capacity-building (

Insurtech (insurance technology) refers to the use of innovative technologies to improve and transform the insurance industry. In relation to disasters, insurtech involves tools like AI-driven risk modeling, satellite imagery, IoT sensors and digital platforms that help insurers better predict, assess and manage disaster risks. For example, insurtech solutions can provide faster and more accurate damage assessments after a hurricane or wildfire, automate claims processing and enable parametric insurance products that trigger instant payouts based on predefined weather events.

Fintech (financial technology) broadly encompasses technology-driven innovations that improve financial services. When applied to disaster and catastrophe risk management, fintech includes financial instruments and platforms that facilitate the transfer and management of catastrophe risks. Catastrophe bonds, for instance, are fintech innovations that allow insurers to transfer disaster risks to the capital markets, raising funds for disaster recovery. Blockchain technology enhances transparency and automation in disaster risk finance by enabling secure, tamper-proof contracts and faster claims payouts.

Microinsurance (insurance products specifically designed for low-income populations offering low premiums, limited coverage and simple terms) and inclusive insurance (which aims to ensure access to affordable insurance for all underserved populations, including informal workers, rural communities, migrants, refugees and other marginalized groups) are an increasingly used tool for building financial resilience into low-income and vulnerable populations, but there is still a significant coverage gap. While coverage has grown by 70 percent in 37 countries over the past three years, only 12 percent of the three billion people who could benefit are currently covered (

Parametric insurance pays out a predetermined amount based on the occurrence of a specific event or condition, rather than on the actual loss incurred. It is based on a trigger, such as wind speed, and requires no inspections or loss adjustment, thus enabling a fast payout – which is useful for disasters, agriculture, drought, and climate-related risks. Take, for example, a coastal business that purchases parametric insurance paying out USD 100,000 if a Category 4+ hurricane passes within 50 miles. If such an event occurs, the company receives the money, regardless of the actual damage incurred.

Whereas parametric insurance pays out a predetermined amount based on the occurrence of a specific event or condition rather than on the actual loss incurred, index-based insurance is a specific type of parametric insurance whose trigger is based on an index, such as rainfall amount, temperature or crop yield average. This index is determined by measured data from a third party, such as weather stations or satellites. For example, a farmer buys rainfall index insurance. If rainfall drops below 50 mm during the growing season (based on satellite data), the farmer will then receive a payout without the need for a time-consuming in-situ assessment. This type of insurance is commonly used in agriculture within developing countries. Importantly, it helps to avoid issues like disputed claims or fraud, and is gaining traction in markets where traditional insurance is too expensive or complex to implement. A further subset of parametric insurance is satellite-indexed insurance. This specifically uses satellite imagery and remote sensing technologies to assess and validate disaster-related claims in areas where ground-based assessments are either difficult or costly, or both. These particular products can trigger payouts based on a predefined threshold, for example, rainfall level, vegetation health measured by the normalized difference vegetation index (NDVI) or soil moisture and drought indicators.

Insurance industry challenges and parametric reinsurance. Reinsurers provide catastrophe policies covering extremely rare events – those that might happen only once every 100, 250 or even 500 years. Consequently, major firms develop models considered adequate for reinsurers to underwrite these catastrophe risks. However, issues emerge when models designed for such rare events are applied to more frequent events occurring every five to 10 years (

The insurance industry is facing an affordability crisis

The insurance industry is facing an affordability crisis, especially with secondary perils like severe convective storms causing rising losses to outpace premiums, thus straining primary insurers. Reinsurers, wary due to past losses and modeling challenges for frequent, less extreme events, are reluctant to increase exposure to such risks. To address this gap, companies such as Demex (see Frontier technologies) are promoting parametric reinsurance to improve protection for insurers. This innovative approach aims to balance risk between insurers and reinsurers, helping stabilize the market without reinsurers withdrawing from secondary peril coverage (

Catastrophe bonds, while fundamentally financial instruments, are intertwined with advanced technology, making them a key innovation in the insurtech and fintech spaces. Their creation and management rely heavily on sophisticated catastrophe modeling that uses AI, satellite data, climate simulations, and other cutting-edge analytics to predict the likelihood and impact of disasters. This modeling informs the design of bond triggers and payout structures by accurately quantifying risk exposure. Additionally, the issuance and trading of “cat” bonds often occurs on digital platforms that use blockchain technology and smart contracts to automate trigger events and payouts, which can contribute to transparency and security. Cat bonds integrate real-time data feeds and early warning systems to connect insurers, reinsurers and capital markets, ultimately bolstering the broader risk management ecosystem.

AI-enhanced catastrophe modeling. The World Bank is exploring the use of AI to enhance catastrophe risk modeling and streamline catastrophe bond transactions. AI can analyze huge datasets to identify patterns and correlations that traditional methods might miss. This approach allows for the more accurate assessment of vulnerabilities and potential economic losses. By improving modeling reliability, AI could facilitate more transactions being made within the catastrophe bond market, potentially increasing investor confidence and participation (

Broadly speaking, AI is increasingly being used within the insurance industry. It can help insurers improve claims processing and make insurance more affordable by lowering transaction costs. As discussed in other chapters in this year’s Green Technology Book, it is being applied for weather prediction, damage assessment and improving resilience in disaster-prone regions. However, the effectiveness of AI depends on the quality of data it uses. Additionally, industry-wide collaboration between different stakeholders is necessary to enable it to reach its full potential for insurance and other disaster response technologies (

Biometrics technologies support disaster relief and fraud prevention – but data concerns remain

Digital ID systems usually consist of multiple technologies working together to enable identification. Because of such complexity, there is no single agreed-upon definition. A digital ID can be a digital version of an identity document, a collection of personal attributes used in a transaction, or a network of digital identifiers that uniquely identify someone (

Fingerprint recognition. In disaster-affected areas, fingerprint biometric systems are used by humanitarian organizations to register individuals, ensuring each person can claim relief without the risk of duplicate or multiple claims being made under different identities. It can be deployed in refugee camps, temporary shelters or at remote field offices.

Facial recognition for aid distribution. In high-traffic disaster response areas, facial recognition technology is used to verify identities at aid distribution points by using pre-recorded images (such as those taken at registration centers).

Iris scans are increasingly used in disaster-prone regions for identification, since the iris is a unique, unchangeable feature. Some organizations like the Indian Red Cross have tested iris-scanning technology to ensure that aid reaches the correct individuals, while reducing administrative overheads and delays.

In regions where infrastructure is damaged, mobile biometric kits allow field officers to register people using a smartphone or portable device. The data collected, including fingerprints, facial or iris scans, can be stored and processed in the cloud, allowing for real-time verification of claims.

Behavioral biometrics for ongoing claim verification. After an initial registration, behavioral biometrics – such as typing patterns, walking gait, and even smartphone usage patterns – can be used to track a claimant’s identity continuously. While still experimental within disaster settings, this kind of behavioral biometric system can potentially be applied more frequently in the future to track aid recipients via digital platforms or cash transfers.

Blockchain with biometric verification. Blockchain technology combined with biometric systems can be used to securely store identity data for disaster victims. Blockchain ensures that once a person’s identity is verified using biometrics, their data cannot be altered. WFP has tested a blockchain-based system using biometric verification for food assistance in refugee camps.

Voice biometrics for remote verification. In areas with limited access to physical biometric devices, voice biometrics can be used over mobile phones. People register their voice patterns, and during subsequent interactions their identity can be verified through their unique voice features. In some developing countries, microinsurance companies are exploring voice biometric systems for verifying claims via mobile phone (

FasterCapital, 2025FasterCapital (2025). Innovations in microfinance. FasterCapital. Available at: https://fastercapital.com/topics/innovations-in-microfinance.html/1 [accessed June 16 2025]. ). In Bangladesh, where mobile money systems like bKash are widespread, voice biometrics are being explored to verify identities before funds are released to individuals who have registered for disaster relief (Bharadwaj et al., 2023Bharadwaj, R, T Mitchell, N Karthikeyan, N Raj, S Chaliha, R Abhilashi, K Chinnaswamy, B Raghini, I Deulgaonkar, D and Chakravarti and T McCabe (2023). Delivering anticipatory social protection: Country readiness assessment. London: International Institute for Environment and Development (IIED). Available at: https://www.preventionweb.net/media/91089/download?startDownload=20250623. ).Biometrics for medical assistance. Disasters often overwhelm health care systems with a surge of patients. In such a situation, biometric technology can play a role in improving medical care by recording the unique physical characteristics of an individual, thereby streamlining patient identification.

UNHCR employs its Biometric Identity Management System (BIMS), which uses fingerprint scanning, iris images and facial photos to create unique biometric records for refugees. This system ensures accurate identification, prevents fraud and enables the efficient delivery of services like food, shelter and cash assistance. BIMS provides a centralized database that is accessible across locations, supports mobile and offline use, and integrates with other systems to streamline operations. To enhance data sharing and coordination, UNHCR uses the PRIMES Interoperability Gateway (PING), a secure platform that allows the safe exchange of biometric and biographical data with partners including WFP. This collaboration has improved food distribution for refugees in Tanzania by enabling WFP to access verified identity data via PING and synch it with WFP’s cloud-based SCOPE platform. SCOPE is used for registering and tracking beneficiaries, deduplicating personal data, managing beneficiary lists, and monitoring assistance delivery (both cash and in-kind). It also supports beneficiary authentication, transfer value management and operational data storage.

The partnership between UNHCR and WFP through their interoperable technologies boosts data transfer speed and adds biometric security to reduce fraud, ensuring aid reaches the correct people efficiently.

Source: (

Biometric vending machines are innovative tools used during a disaster response to provide essential supplies like food, water and emergency items quickly and securely. In Japan, disaster-response vending machines have been used since 2007, having first been developed by the Institute of Disaster Mitigation and Coca-Cola West. They automatically dispense resources during emergencies, providing water, electricity and information, while using biometric authentication to control access. In India, the GrainATM (Annapurti) is a biometric-enabled automated grain dispenser that provides subsidized grains 24/7 to beneficiaries under the Public Distribution System. Launched in Odisha and supported by WFP, it allows ration card holders to quickly access up to 50 kg of grains with biometric verification, cutting waiting times by 70 percent (WFP, 2024c).

Significant biometric data technology challenges remain. In camps like Dadaab in Kenya, refugees have faced challenges such as biometric data not being recognized, delays in aid distribution and restrictions on the types of food or services they can purchase. Cash assistance is often restricted to specific vendors, which limits choice. Additionally, some refugees feel trapped by the need for biometric verification to maintain access to assistance, which can limit their mobility and economic freedom (

Innovation examples

AI-driven cash relief before and after disasters strike

In response to Hurricanes Helene and Milton, disaster aid delivery has been transformed using AI. The nonprofit organization GiveDirectly is pioneering a direct cash assistance program, having provided $1,000 payments to nearly 1,000 households in North Carolina and Florida. This approach aims to rush relief to those most affected by leveraging Google’s machine learning tools to identify high-need households in disaster zones. Using AI to analyze satellite imagery and poverty data, GiveDirectly targets communities with significant damage and economic vulnerability. Eligible recipients are invited to enroll via the Propel app, where funds are deposited directly onto debit cards, reducing delays and documentation burdens typical of traditional aid programs. Direct cash assistance offers recipients flexibility in addressing diverse needs such as food, clothing, childcare and bill payments. While the model has proven effective, limitations include the requirement for smartphone access and internet connectivity, which exclude some vulnerable populations. GiveDirectly plans to expand its reach through hybrid remote and in-person assistance. Additionally, Google is using AI to predict severe floods up to a week in advance, enabling the International Rescue Committee and GiveDirectly to send cash transfers before disasters strike. This anticipatory aid, piloted in Nigeria and Mozambique, uses satellite data, government information and mobile money platforms to identify at-risk populations and deliver funds quickly (

African Risk Capacity (ARC) Group parametric insurance payouts power rapid climate crisis relief in Zimbabwe and Somalia

_group.png)

The African Risk Capacity (ARC) Group pioneers parametric disaster insurance solutions across Africa, providing rapid financial support to countries facing climate-induced crises. In 2024, Zimbabwe received a historic payout of USD 16.8 million to aid drought-affected populations amid severe food insecurity caused by El Niño. This payout was triggered by ARC’s Africa RiskView software, an early warning system that automatically releases funds based on predefined drought severity metrics impacting over 4.7 million people. Through the ARC Replica program, humanitarian organizations can purchase insurance policies that complement governments’ insurance coverage, thereby increasing protection for populations against climate risks. Humanitarian partners World Food Programme (WFP) and Start Network have received USD 6.1 million and USD 8.9 million, respectively, enabling humanitarian organizations to deliver timely or early assistance to vulnerable populations following a shock. Premiums are supported by donors including the Swiss Agency for Development and Cooperation and KfW, a German development bank, ensuring predictable emergency funding. Somalia also secured USD 1.46 million from ARC’s sovereign drought insurance pool for the 2024/25 season, with Start Network receiving $728,000 via Replica to provide cash transfers to over 45,000 drought-impacted households. These efforts represent a shift from reactive aid to prearranged risk financing, showcasing how ARC’s parametric insurance and Replica program use technology-driven risk monitoring and prearranged financing to strengthen disaster resilience across Africa (

Blockchain-based index insurance protects Southeast Asia’s coffee farmers from climate risk

Insurtech company Igloo has expanded its blockchain-based parametric Weather Index Insurance to coffee farmers in Southeast Asia, building on the success of its program for rice farmers. Launched in Vietnam’s Central Highlands, the program covers five provinces and insures plots as small as 0.1 hectares at a cost starting around USD 42 per hectare, with coverage up to USD 1,700. The insurance uses rainfall data and pre-assigned loss values to automate claims, eliminating the need for on-site damage assessment and ensuring fast, transparent payouts. Smart contracts hosted on a public blockchain guarantee consistency and trust in the payout process. Igloo partners with local insurers, meteorological agencies and international reinsurers to implement the program. This is crucial, as climate change increasingly threatens coffee crops across the region with drought, erratic rainfall and suboptimal temperatures that jeopardize farmer livelihoods, as well as global supply chains. By using big data, real-time risk assessment and automated claims management, Igloo’s model counters the high cost, delays and inefficiencies of traditional agricultural insurance and helps small-scale farmers protect their income, while adapting to growing climate volatility (

Proven technology solutions

Insurance and risk transfer: agriculture disaster insurance

ACRE Africa

ACRE Africa is an agricultural and climate risk enterprise offering innovative insurance solutions to smallholder farmers across Africa. Its approach includes providing weather index-based insurance products, such as Bima Pima, which allow farmers to pay premiums in small, affordable installments via mobile money platforms like M-Pesa. These products are designed to trigger automatic payouts based on weather data, eliminating the need for on-site inspection and reducing administrative costs. ACRE Africa collaborates with local partners, including mobile network operators and agro-dealers, to distribute insurance products and build trust within farming communities. Its use of technology, including satellite data and blockchain for smart contract automation, enhances the efficiency and scalability of services. Since its inception, ACRE Africa has expanded its reach to over 3.1 million farmers across multiple African countries.

Technological maturity: Proven

Contracting type: For sale

Technology level: Medium

Place of origin: Kenya

Availability: Sub-Saharan Africa

Contact: WIPO Green Database

Insurance and risk transfer: bespoke parametric insurance

Descartes Underwriting

Descartes Underwriting delivers advanced parametric insurance using AI, satellite imagery and real-time data analytics to protect businesses from disasters like hurricanes, earthquakes, floods and extreme weather. Policies trigger automatic payouts when specific conditions – such as wind speeds or seismic activity – are met, so as to enable fast claims-free financial relief. By integrating machine learning and sensor data, Descartes builds precise, dynamic risk models that capture climate trends and local hazards. Focused on large corporate clients, its offers scalable solutions covering extensive geographical areas worldwide. Descartes issues policies on A-rated paper (referring to insurance policies or contracts that are backed by insurers with an “A” (Excellent) rating from independent rating agencies like A.M. Best, Standard & Poor’s, and Moody’s), and is supported by leading reinsurers.

Technological maturity: Proven

Contracting type: For sale

Technology level: Medium

Place of origin: France

Availability: Worldwide

Contact: WIPO Green Database

Cash transfers and financial inclusion platforms: mobile money platform

bKash

bKash operates as a mobile-based digital payment platform that leverages USSD and smartphone apps to provide secure, easy-to-use financial services. It enables users to send money, pay bills, recharge mobile phones and access banking services without the need for a traditional bank account. USSD works over the GSM network and allows users to access financial services by dialing codes on basic feature phones. The platform integrates with Bangladesh’s banking infrastructure and uses robust encryption and authentication methods to ensure transaction security. Its technology supports real-time transactions, interoperability with other financial institutions, and scalability to serve millions of users, making digital finance accessible even in remote or underserved areas.

Technological maturity: Proven

Contracting type: Subscription or usage-based services

Technology level: Medium

Place of origin: Bangladesh

Availability: Bangladesh

Contact: WIPO Green Database

Cash transfers and financial inclusion platforms: mobile money platform

M-Pesa

M-Pesa is Africa’s leading mobile money service and the continent’s largest fintech platform. It offers a safe, convenient way for both banked and unbanked people to make payments and access financial services. Launched in 2007 by Safaricom, Vodafone’s Kenyan partner, M-Pesa now serves over 60 million customers across eight African countries. M-Pesa uses SMS and USSD technology to enable financial transactions on basic mobile phones without internet. It links mobile numbers to digital wallets for sending money, paying bills and more. The system operates on a secure, centralized platform that processes transactions instantly and integrates with banks and agents for cash services. Robust encryption and authentication ensure user security. In 2020, Vodacom and Safaricom acquired the M-Pesa brand from Vodafone Group through a joint venture, giving them full control over product development and support.

Technological maturity: Proven

Contracting type: Subscription or usage-based services

Technology level: Medium

Place of origin: Kenya

Availability: Democratic Republic of Congo, Egypt, Ethiopia, Ghana, Kenya, Lesotho, Mozambique, South Africa and Tanzania

Contact: WIPO Green Database

Insurance and risk transfer: crop and weather monitor with built-in index viewer

Swiss Re

Swiss Re, a large Swiss reinsurance company, is expanding its parametric agricultural insurance to help smallholder farmers and public sector clients manage climate risks like droughts, floods and heatwaves. Using predefined triggers such as rainfall, soil moisture, temperature and vegetation indices, payouts are made automatically and faster without the need for traditional claims processing. The company’s Opti-Crop platform leverages near real-time satellite and weather data to enhance transparency and reduce delays. Swiss Re supports insurers and governments in product design and data integration, aiming to better align payouts with actual losses. Active in South America, Central Asia, Africa, and Southeast Asia, Swiss Re offers standardized indices that include soil moisture, rainfall, temperature, normalized difference vegetation index (NDVI) (vegetation density) and area yield to track environmental conditions and improve insurance access.

Technological maturity: Proven

Contracting type: For sale

Technology level: Medium

Place of origin: Switzerland

Availability: Worldwide

Contact: WIPO Green Database

Insurance and risk transfer solutions: index-based livestock and yield index insurance

Pula

Pula’s insurance products use satellite technology and data analytics to protect farmers and pastoralists. Its Index-Based Livestock Insurance (IBLI) uses satellite-derived NDVI data to monitor pasture health and detect grazing shortages caused by drought or delayed rains. This enables timely payouts to support livestock care during critical periods. For crops, Pula’s Yield Index Insurance (YII) divides regions into agro-ecological zones using historical climate and yield data. Satellite and ground data help measure actual yields at season’s end, triggering compensation if yields fall below set thresholds. A hybrid insurance combines Weather Index Insurance (WII) and YII, using weather data and yield measurements to deliver fast payouts for weather-related losses and broader coverage for drought, floods, pests and diseases. This enables efficient risk assessment and rapid financial support without the need for individual loss verification.

Technological maturity: Proven

Contracting type: For sale

Technology level: Medium

Place of origin: Switzerland

Availability: Ethiopia, Kenya, Nepal and Nigeria

Contact: WIPO Green Database

Cash transfers and financial inclusion platforms: blockchain-based decentralized donation platform

Giveth

Giveth is a blockchain-based donation platform that uses Ethereum smart contracts to ensure transparency and accountability in funding social impact projects, allowing donors to track exactly how and where their contributions are used in real time. Giveth uses decentralized technology to reduce reliance on traditional intermediaries, creating a direct and auditable link between donors and projects. The platform supports recurrent donations, milestone-based funding, and integrates with Web3 wallets – digital wallets that allow users to interact with decentralized applications (dApps) and blockchain networks, especially those built on platforms like Ethereum. Unlike traditional wallets used for storing fiat currency, Web3 wallets manage cryptographic keys – enabling users to store, send and receive cryptocurrencies and digital assets, and to authenticate themselves on decentralized platforms without needing a username or password. Giveth is open source, enabling global participation in supporting charitable causes through cryptocurrency.

Technological maturity: Proven

Contracting type: Open source

Technology level: Medium

Place of origin: Switzerland

Availability: Worldwide

Contact: WIPO Green Database

Cash transfers and financial inclusion platforms: blockchain-based platform for impact projects

Alice SI

Alice SI is a blockchain-based platform designed to bring transparency and accountability to charitable donations. It uses Ethereum smart contracts to ensure that funds are only released when verified outcomes are achieved, helping build trust between donors and organizations. The platform integrates technologies like Etheroscope, which visualizes smart contract data in real time, and Sensor TRX, which uses IoT and APIs to automate impact validation – the platform connects to devices and software systems to automatically track whether specific outcomes have been achieved without requiring manual checking. In areas with limited connectivity, Alice also offers Tappy, a contactless wallet that allows beneficiaries to validate impact and access funds. By combining blockchain with real-time data and verification tools, Alice SI ensures that donations are traceable in order to increase donor confidence and facilitate more effective social impact funding.

Technological maturity: Proven

Contracting type: Open source

Technology level: Medium

Place of origin: United Kingdom

Availability: Worldwide

Contact: WIPO Green Database

Insurance and risk transfer solutions: catastrophe bonds

World Bank

.jpg)

The World Bank’s Capital at Risk (CAR) Notes program helps transfer disaster-related financial risk from countries to global investors by issuing catastrophe and pandemic bonds. These bonds may risk investors’ principal and are issued under the World Bank’s Global Debt Issuance Facility, benefiting from tax and securities law exemptions, but often without a credit rating. Unlike traditional catastrophe bonds that use a special purpose vehicle (SPV) to issue bonds and hold collateral, the World Bank issues bonds directly and manages contracts, investments and payments. In this setup, the sponsor (a country or client) enters into an insurance or derivative contract with the World Bank. The bonds pay out when predefined disaster events – for example, when an earthquake or storm meets parametric criteria – occur. For example, in Mexico, payouts triggered by such events are routed through intermediaries like Swiss Re and Agroasemex. If no disaster happens, investors receive their principal back at maturity. This program helps countries manage risks from disasters by tapping global capital markets efficiently.

Technological maturity: Proven

Contracting type: Risk transfer agreement/structured finance product

Technology level: Medium

Place of origin: United States

Availability: Worldwide

Contact: WIPO Green Database

Insurance and risk transfer solutions: climate risk insurance as a part of a comprehensive risk management package

World Food Programme

Over the past decade, the World Food Programme (WFP) has expanded access to climate risk insurance, reaching over 10.5 million people through a portfolio of products, including weather index, area yield, hybrid index, livestock index and business interruption insurance. These products protect vulnerable groups that include smallholder farmers, pastoralists and micro, small and medium enterprises (MSMEs) from climate-related perils such as drought, excessive rainfall and pests. In 2024 alone, WFP facilitated access to insurance for three million people across 15 countries with over USD 41 million in payouts benefiting more than 1.5 million people. WFP embeds insurance into broader financial services and resilience-building strategies by linking premium subsidies to disaster risk reduction and climate adaptation efforts, integrating insurance with savings, loans and market access, and promoting crop-agnostic coverage to support livelihood diversification. It also develops Forecast Index Insurance to unlock pre-disaster financing for Anticipatory Action. These integrated models enhance risk protection and incentivize adaptive practices and investment.

Technological maturity: Proven

Contracting type: For collaboration

Technology level: Medium

Place of origin: Ethiopia

Availability: Bangladesh, Burkina Faso, Cộte d’Ivoire, Cuba, Ethiopia, the Gambia, Guatemala, Haiti, Iraq, Kenya, Kyrgyz, Madagascar, Malawi, Mozambique and Senegal

Contact: WIPO Green Database

Frontier technology solutions

Risk assessment and modeling tools: climate risk models and insurance mapping tool

SkyFi

SkyFi delivers advanced geospatial analytics specifically designed for the insurance sector to improve risk assessment, claims management and disaster response. Using high-resolution satellite imagery and remote sensing, SkyFi helps insurers evaluate environmental risks, such as flood likelihood, soil moisture and terrain changes over time, thereby enabling precise underwriting and risk modeling. After disasters, like a flood or fire, insurers can quickly assess structural damage remotely, speeding up claims prioritization and processing. Real-time geospatial data also supports emergency response by mapping impact severity and optimizing service routes. Additionally, SkyFi offers continuous monitoring of insured assets to detect early signs of damage or wear, helping reduce claim frequency by enabling proactive maintenance. This data-driven approach allows insurance companies to improve accuracy, reduce costs and enhance customer service by responding faster and more effectively to risks and claims. Overall, SkyFi empowers insurers with actionable insights through satellite technology to manage risks and optimize operations efficiently.

Technological maturity: Frontier

Contracting type: For sale

Technology level: Medium

Place of origin: United States

Availability: Worldwide

Contact: WIPO Green Database

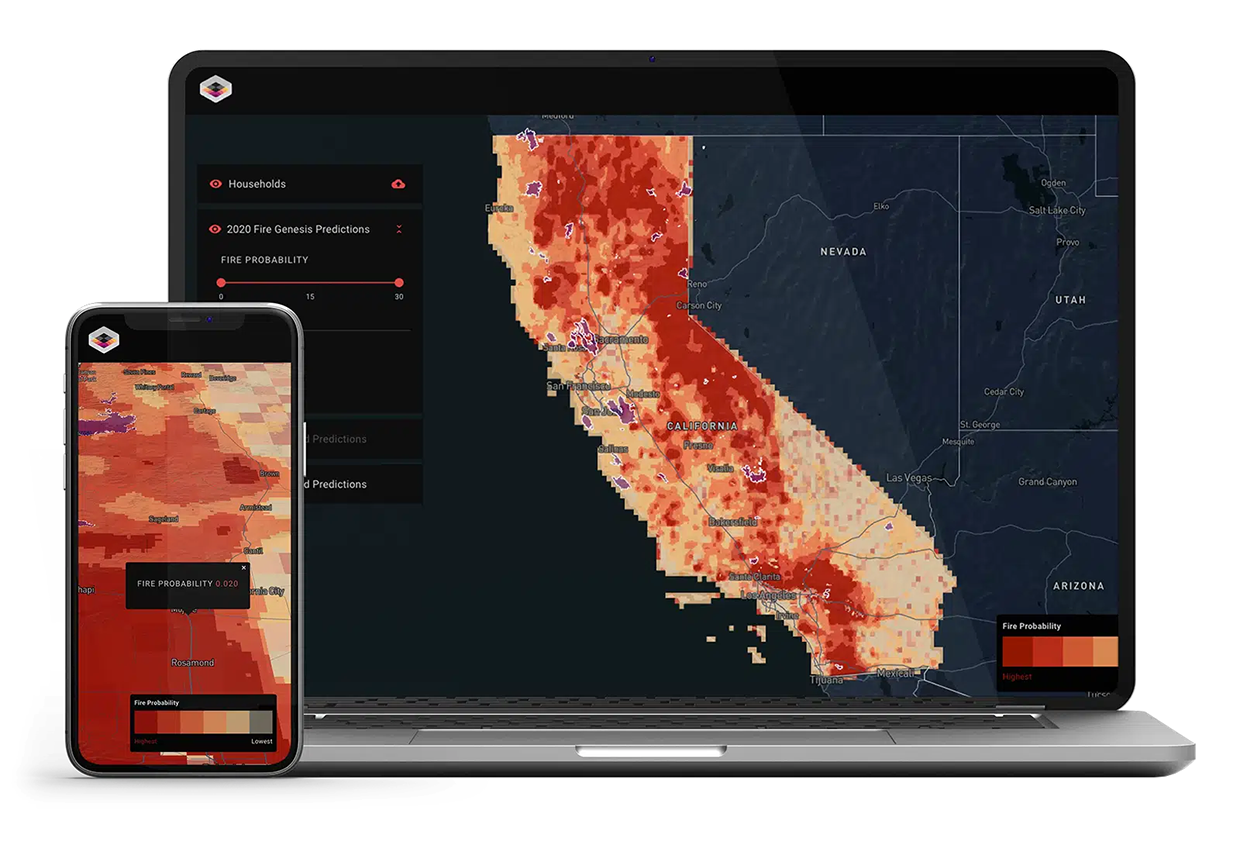

Risk assessment and modeling tools: parametric wildfire and hurricane insurance

Kettle

Kettle uses proprietary machine learning algorithms that analyze billions of data points from sources like NASA, NOAA, and the European Space Agency. This technology processes vast raw data through an ETL (referring to “extract, transform, load,” a data processing method used to collect data from multiple sources (extract), clean and organize it into a usable format (transform), and then load it into a database or system where it can be analyzed or used (load) pipeline to train deep neural networks, generating over two million high-resolution wildfire footprints at 100-meter scale. Kettle’s suite of models – including Ignition, Contagion, Building Vulnerability, Fire Edge Downscaling, and Parcel Risk Assessment – predict wildfire risks by simulating ignition and spread patterns across millions of grid cells. Kettle’s Genesis Model divides areas into micro-grids, analyzing factors driving wildfire ignitions monthly. Using deep long short-term memory convolutional neural networks, Kettle accurately captures the temporal and spatial dynamics of wildfire spread.

Technological maturity: Frontier

Contracting type: For partnership and collaboration

Technology level: Medium

Place of origin: United States

Availability: Worldwide

Contact: WIPO Green Database

Cash transfers and financial inclusion platforms: instant disbursements via digital identity

AID:Tech

AID: Tech’s Kare platform is a digital aid distribution system designed to improve disaster relief by using blockchain and digital identity verification. Funds are sent directly to recipients inside digital wallets accessible via mobile apps. Users can spend these funds using virtual Visa debit cards, which work with Apple Pay and Google Pay. The platform allows customizable disbursement controls, such as restricting purchases of alcohol or tobacco. Kare offers real-time tracking of aid distribution and resource usage, ensuring transparency. Additionally, it partners with Amazon to deliver physical goods directly to those in need.

Technological maturity: Frontier

Contracting type: For licensing

Technology level: Medium

Place of origin: Ireland

Availability: Worldwide

Contact: WIPO Green Database

Cash transfers and financial inclusion platforms: blockchain payment solution for digital cash distribution

Stellar

UNHCR, in partnership with the Stellar Development Foundation (SDF), has launched a pioneering blockchain-based payment solution using the Stellar network to deliver cash assistance to internally displaced persons (IDPs) and war-affected people within Ukraine. The pilot distributes funds in USD Coin (USDC), a stablecoin, directly into recipients’ digital wallets accessible via smartphones. This allows beneficiaries to use or withdraw money globally at MoneyGram locations. The solution ensures full traceability and accountability. Initially piloted in the cities of Kyiv, Lviv and Vinnytsia, the platform aims to expand globally. This initiative complements UNHCR’s long-standing commitment to cash-based interventions, which have delivered nearly USD 5 billion to over 35 million people worldwide.

Technological maturity: Frontier

Contracting type: Collaborative humanitarian solution

Technology level: Medium

Place of origin: Ukraine

Availability: Ukraine (with plans to expand)

Contact: WIPO Green Database

Cash transfers and financial inclusion platforms: rescue card/Zinli

World Food Programme

When emergencies occur, WFP’s cash-based assistance can take up to six months to set up without existing payment arrangements. Many unbanked individuals are excluded due to strict Know Your Customer (KYC) requirements (a set of rules financial institutions and organizations follow to verify the identity of their clients. The goal is to prevent fraud, money laundering and terrorist financing). The Rescue Card, a prepaid, reloadable card linked to WFP’s digital wallet, offers immediate aid within 72 hours, with flexible KYC to include marginalized groups. As of 2025, it has helped over 88,000 people across eight countries. Rescue Card has cut costs by 70–85 percent and reduced delivery times by up to two years. In 2024, most assistance—56 percent to 68 percent—went directly to women, with 80 percent spent on food. To boost preparedness, 5,000 cards were prepositioned in Barbados ahead of Hurricane Beryl. Nowadays, Rescue Card is prepositioned in eight countries to support emergency operations and anticipatory action.

Technological maturity: Frontier

Contracting type: For collaboration

Technology level: Medium

Place of origin: Panama

Availability: Barbados, Bolivia (Plurinational State of), Cuba, Dominican Republic, Guatemala, Haiti , Honduras, Peru

Contact: WIPO Green Database

Risk assessment and modeling tools: AI solution for assessing damage caused by disasters

Tractable

Tractable’s AI Property solution uses AI to rapidly assess external building damage due to wind, hail and hurricanes, cutting damage evaluation time from months to a single day. Homeowners simply upload photos via a mobile web app, and AI processes them in order to estimate damage and submit a report to insurers. This technology is currently being used by Japan’s MS&AD Insurance Group, as it was during Typhoon Mindulle in 2021, helping expedite claims and recovery. The AI focuses on external damage, such as to fences and walls, and there are plans to include indoor damage such as from water leaks and smoke. Initially, human experts verify AI assessments, but the system is designed to learn and move toward full automation. AI Property is also available in North America, aiming to help insurers respond faster to disasters and improve customer support during crises.

Technological maturity: Frontier

Contracting type: For licensing

Technology level: Medium

Place of origin: United Kingdom

Availability: Japan, North America

Contact: WIPO Green Database

Insurance and risk transfer solutions: bespoke index-based insurance

IBISA

IBISA is a climate InsurTech specializing in parametric insurance solutions that protect against weather-related risks, mainly within agriculture. Its index-based policies trigger automatic payouts when predefined weather conditions – such as extreme rainfall, cyclones or temperature anomalies – are met, thereby eliminating lengthy claims processes and providing fast financial aid. Recently, IBISA raised EUR 2.8 million from investors, including The Acumen Resilient Agriculture Fund, Equator, and the Asian Development Bank Ventures, to expand into emerging markets in Asia and Africa. IBISA’s approach involves analyzing local weather data to define tailored triggers relevant to each region. Once a weather event exceeds these thresholds, satellite data is reviewed and claims processed within 10 days.

Technological maturity: Frontier

Contracting type: For sale

Technology level: Medium

Place of origin: Luxembourg

Availability: Africa, Asia

Contact: WIPO Green Database

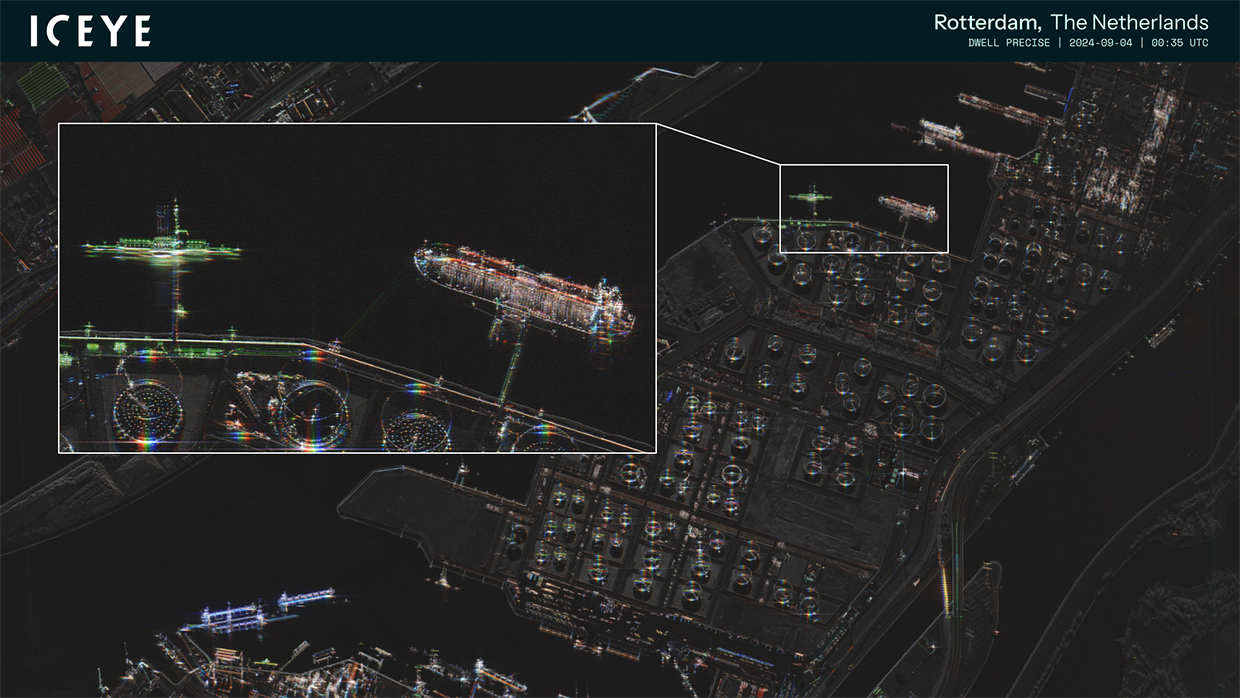

Risk assessment and modeling tools: multi-peril data solution for catastrophes related to natural hazards

ICEYE

ICEYE operates the world’s largest synthetic aperture radar (SAR) satellite constellation, with 50+ satellites launched to date, to deliver near real-time observation data on natural catastrophes such as floods, hurricanes, earthquakes, and wildfires. Unlike optical sensors, SAR technology functions continuously—day or night, through cloud, smoke, and ash—ensuring reliable information in all conditions. ICEYE’s Multi-Peril Data Solution integrates these observations into GIS-ready hazard and damage layers, enabling insurers to obtain comprehensive situational awareness within hours of an event. By replacing model-based projections with observed evidence, the technology accelerates loss assessment, improves claims prioritization, and enhances the precision of underwriting and pricing. Through timely, observation-based catastrophe intelligence, ICEYE strengthens financial resilience and supports climate adaptation within the insurance sector.

Technological maturity: Frontier

Contracting type: For licensing

Technology level: Medium

Place of origin: Finland

Availability: Worldwide

Contact: WIPO Green Database

Horizon technology solutions

Insurance and risk transfer solutions: enhanced parametric insurance pilot

Mercy Corps Ventures and MiCRO

Mercy Corps Ventures and MiCRO have launched a pilot in Guatemala to reduce basis risk in parametric insurance for smallholder farmers. The initiative establishes a Basis Risk Fund that compensates farmers when qualifying climate-related losses occur but do not trigger payouts under existing parametric policies. To improve accuracy and affordability, the project will test technology-led methods to verify field losses, including the use of drones to assess crop damage, and compare their cost-effectiveness against traditional, in-person verification. Data and insights from the pilot will be used to refine the parametric insurance model, improve event identification and evaluate the long-term sustainability of the fund. Developed in partnership with Guatemala’s Ministry of Agriculture, the pilot aims to strengthen farmers’ trust in insurance products, enhance climate resilience and identify scalable ways to deliver faster, fairer compensation for farmers affected by extreme weather.

Technological maturity: Horizon

Contracting type: N/A

Technology level: Medium

Place of origin: Guatemala

Availability: Guatemala

Contact: WIPO Green Database

Insurance and risk transfer solutions: blockchain-integrated carbon credit-backed insurance

Ryskex/Arx Veritas

The Arx Veritas Parametrics Cell, developed by Ryskex and Arx Veritas, uses blockchain and AI to transform climate risk into investable assets using 10 million emission reduction units (ERUs). The cell, within the Veritas Ex Machina platform, turns carbon credits (10 million emission reduction units valued at $73 each) into investable, auditable assets. The initiative integrates blockchain (via Redbelly Network) and AI-driven underwriting to create a fraud-proof framework for climate-related risk transfer. Launched in April 2025, it uses Token “X” (a blockchain-based token or digital asset that represents a stakeholder’s ownership or investment – letting investors share in financial outcomes linked to carbon credit-backed insurance) to enable secure participation by institutional investors. The cell applies parametric principles relying on data-driven triggers similar to disaster risk models to facilitate payouts.

Technological maturity: Horizon

Contracting type: Under development

Technology level: Medium

Place of origin: United Kingdom

Availability: N/A

Contact: WIPO Green Database

Insurance and risk transfer solutions: parametric heat insurance for women workers

Climate Resilience for All

Source: CRA/Rameshwar Bhatt

Starting in April 2024, Climate Resilience for All launched the one year-long Women’s Climate Shock Insurance and Livelihood Initiative (WCSI). The program combined parametric microinsurance, direct cash assistance, and early warning systems to support women facing income and health risks from extreme heat while working in the informal sector. Implemented with the Self-Employed Women’s Association in India and underwritten by Swiss Re Public Sector Solutions, the pilot covered 50,000 women across 23 districts in Gujarat, Maharashtra, and Rajasthan. Direct cash assistance equivalent to about two day’s wages was provided when temperatures reached 40°C for two consecutive days, while the insurance issued larger one-time payouts at higher thresholds between 42–43.5°C. Premiums averaged six dollars annually, shared between participants and philanthropic contributions. The model integrates historical climate data for threshold design and aims to advance toward forecast-based financing. WCSI is planned for expansion to Thailand, Pakistan, and Sierra Leone, and coverage for floods and cyclones is being examined.

Technological maturity: Horizon

Contracting type: For collaboration

Technology level: Medium

Place of origin: South Africa

Availability: India

Contact: WIPO GREEN Database

Insurance and risk transfer solutions: parametric climate derivatives platform

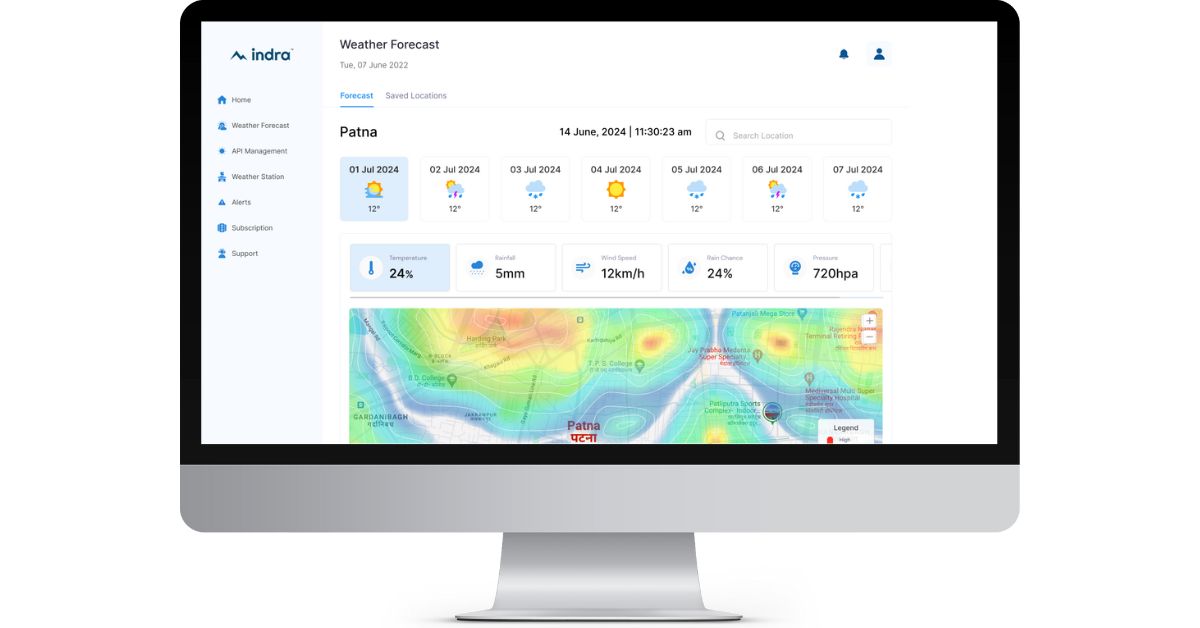

mistEO

Source: mistEO

In 2024, mistEO launched IndraWeather, a weather intelligence platform delivering hyper-local, real-time weather data and forecasting. It utilizes sources including the proprietary "Indra Numerical Weather Prediction Model", satellite imagery, radar systems, and in situ automated weather stations. The processed data feeds into mistEO's suite of Climate Decision Intelligence platforms, providing, for instance, livestock farmers with tools for informed decision-making, including weather-related alerts and actionable insights on topics ranging from heat stress in cattle to preparing farms for inclement weather. IndraWeather data also supports parametric insurance solutions across agriculture, renewable energy, mobility, and marine industries, and mistEO is now developing a weather parametric derivatives platform for broader applications across these verticals. This platform will consist of financial tools enabling businesses to hedge against weather-related risks, such as logistics disruptions from the sudden onset of heavy snow, and will be offered to banking and insurance companies designing bespoke financial products.

Technological maturity: Horizon

Contracting type: For collaboration

Technology level: High

Place of origin: India

Availability: N/A

Contact: WIPO GREEN Database