New WIPO Study Gives First-Ever Figures on Value of "Intangible Capital" in Manufactured Goods

Geneva,

November 20, 2017

PR/2017/813

Go to: WIPR findings | Case studies: Smartphones, Coffee, Solar panels

First-ever figures reveal that nearly one third of the value of manufactured products sold around the world comes from “intangible capital,” such as branding, design and technology, according to a WIPO study of the global value chains companies use to produce their goods.

Videos: Highlights Video | Press conference Video (watch on YouTube) | Launch event

World Intellectual Property Report 2017

The World Intellectual Property Report 2017 examines the crucial role of intangibles such as technology, design and branding in international manufacturing.

DownloadIntangible capital will increasingly determine the fate and fortune of firms in today’s global value chains.

WIPO DG Francis Gurry

This amount, some USD 5.9 trillion in 2014, shows that intangible capital contributes twice as much as buildings, machinery and other forms of tangible capital to the total value of manufactured goods. This underscores the growing role of intellectual property, which is frequently used to protect intangible and related assets in the worldwide economy.

The "World Intellectual Property Report 2017: Intangible Capital in Global Value Chains" (WIPR 2017) looks at how much income accrues to labor, tangible capital and intangible capital in global value chain production across all manufacturing activities, representing one quarter of total global economic output, with case studies focusing on coffee, solar panels and smartphones. It examined national accounts and international trade statistics from around the world and company data to provide these economic insights.

"Intangible capital will increasingly determine the fate and fortune of firms in today’s global value chains. It is behind the look, feel, functionality and general appeal of the products we buy and it determines success in the marketplace," said WIPO Director General Francis Gurry. "Intellectual property, in turn, is the means by which companies secure the competitive advantage flowing from their intangible capital."

Some WIPR 2017 findings

- Intangible capital accounted, on average, for 30.4 percent of the total value of manufactured goods sold throughout 2000-2014.

- The intangible capital share rose from 27.8 percent in 2000 to 31.9 percent in 2007, but has remained stable since then.

- Overall, income from intangibles increased by 75 percent from 2000 to 2014 in real terms, amounting to USD 5.9 trillion in 2014.

- Three product groups – food products, motor vehicles and textiles – account for close to 50 percent of the total income generated by intangible capital in the manufacturing global value chains.

Smartphones: Substantial Returns Driven by Intangible Capital

WIPR 2017, Chapter 4 – Smartphones: What's inside the box?

Apple and Samsung dominate the market for high-end phones that cost more than USD 400, with market shares of 57 percent and 25 percent, respectively. In this segment, crucial intangible assets include technology, the design of hardware and software, and branding. The WIPR 2017 finds that for every iPhone 7 that Apple sells for approximately USD 810, about 42 percent of the sales price is captured by Apple – a proxy for the high returns from intangible capital in the industry. Huawei and Samsung also capture significant value in their top-end smartphone models, despite their lower consumer prices and sales volume.

The WIPR 2017 also finds that component makers - like Corning Inc., the producer of iPhone Gorilla Glass – and technology providers including Nokia Corp. and Qualcomm Inc., use intangible assets to capture substantial value.

Smartphone firms and technology providers rely heavily on patents, trademarks and industrial designs, generating a high return on their intangible capital. Indeed, in the domain of patents, up to 35 percent of all first filings worldwide may relate to smartphones. The report finds that the 4th-generation (4G) cellular standard used today is associated with close to four times more patents than the 2nd-generation standard.

Another particularly fast growing area of filing activity concerns graphical user interfaces (GUIs), such as icons for mobile apps. For example, Apple filed 222 designs on GUIs at the European Union Intellectual Property Office between 2009 and 2014, while Samsung filed 379.

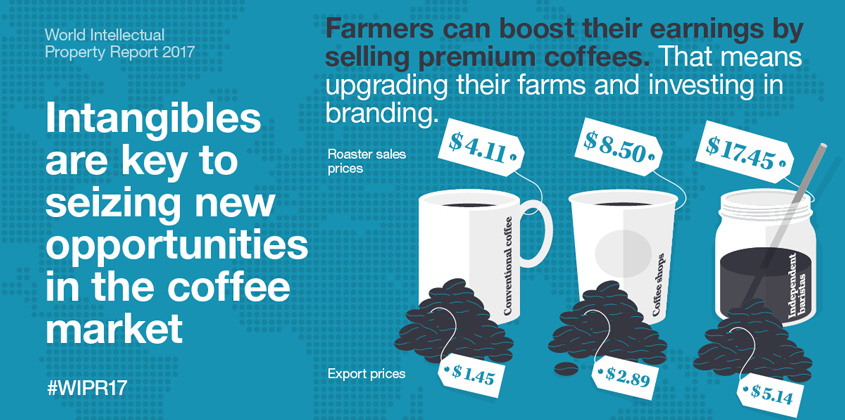

Coffee: New Consumer Preferences Driving Value

WIPR 2017, Chapter 2 – Coffee: how consumer choices are reshaping the global value chain

Technology plays a key role in the transformation of a coffee bean into a cup of brew. The WIPR 2017 maps patent data in the sector, finding that innovation across the supply chain increases in activities closer to consumers. This includes the processing of beans and the final distribution of coffee products, such as the coffee capsules found in many homes and offices.

Brand reputation and image allow firms to differentiate their offering from those of their rivals and play an important role in all coffee market segments, including soluble and roasted coffee sold in grocery stores, as well as espresso-based coffee products sold in retail coffeehouses.

Shifting consumer preferences have progressively transformed the global coffee value chain, moving from consumption in the home, then in coffeehouses and now to a new generation of discerning consumers who are interested in their coffee product’s back story, willing to pay premium prices.

Prices commanded in this so-called “third wave” market segment can exceed those in “first wave” consumption by more than four times, with coffee farmers’ incomes tripling. While still small in size, this fast-growing market segment offers new opportunities for greater participation in the global value chain by developing economies. In particular, information on the origin and variety of the coffee beans, how they were farmed and processed, and farmers’ compensation become integral to selling coffee.

Responding to the shifting consumer preferences, coffee growers and even countries are investing in efforts to move beyond generic coffee, adopting their own branding strategies.

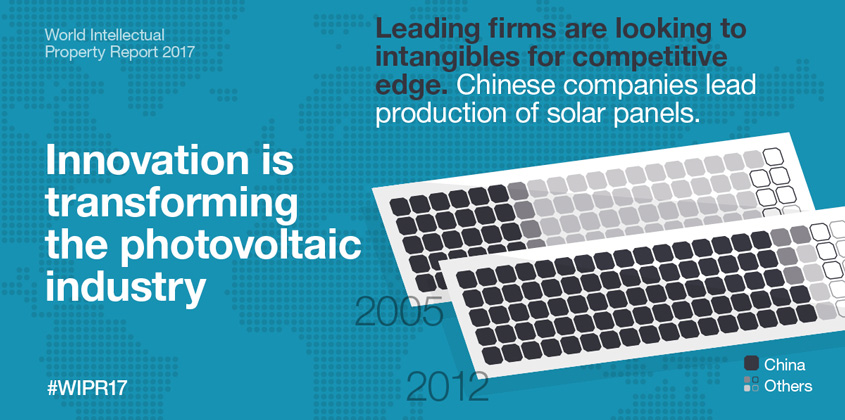

Solar Panels: Technological Innovation Prompts Profound Shifts

WIPR 2017, Chapter 3 – Photovoltaics: technological catch-up and competition in the global value chain

Technological innovation – as the main form of intangible capital – is prompting profound shifts in the global manufacturing value chain for photovoltaic (PV) solar panels, which are increasingly found worldwide.

Solar panels have moved from highly specialized products to low-cost commodities, putting pressure on producers. Between 2008 and 2015 prices fell by an estimated 80 percent. In particular, companies have reduced production costs by investing in more powerful production equipment, realizing efficiencies through complementary process innovations and achieving large scale production.

Chinese manufacturers have progressively increased their market share, putting many traditional PV manufacturers in the U.S., Europe and elsewhere, as well as some firms within China, under competitive pressure, resulting in bankruptcies and acquisitions.

The WIPR 2017 shows that overall patent filings in the photovoltaic sector have declined since 2011. In the U.S., Europe and Japan – the traditional sources of innovation in the sector – the decline has been sharp, due to the exit of many firms. However, the surviving firms in these areas have stepped up their investments in research and development (R&D) to develop new PV technologies.

In China, patenting has continued to grow in the sector, including from new firms that have entered the sector. Yet, the proportion of Chinese solar panel patent applications filed in other countries remains below 2 percent.

Many companies are seeking growth in local service markets – such as the installation of solar panels in private homes. In such consumer markets, company and product branding are key intangible assets that help attract consumers and project finance.

About the WIPR

The World Intellectual Property Organization publishes the WIPR every two years, with each edition focusing on specific trends in an area of IP. Previous reports have explored how breakthrough innovations drive economic growth, what role brands play in a global marketplace and how the face of innovation is changing.

About WIPO

The World Intellectual Property Organization (WIPO) is the United Nations agency that serves the world’s innovators and creators, ensuring that their ideas travel safely to the market and improve lives everywhere.

We do so by providing services that enable creators, innovators and entrepreneurs to protect and promote their intellectual property (IP) across borders and acting as a forum for addressing cutting-edge IP issues. Our IP data and information guide decisionmakers the world over. And our impact-driven projects and technical assistance ensure IP benefits everyone, everywhere.

For more information, please contact the News and Media Division at WIPO:- Tel: (+41 22) 338 81 61 / 338 72 24