Intangible assets now represent nearly USD 80 trillion globally, making intellectual property (IP) finance key to accessing affordable capital that powers economic development. The third edition of the IP Finance Dialogue brought together policymakers, financial experts, innovators, and academics from over 10 countries to explore how greater transparency and better information can build trust and unlock the full economic potential of IP.

Bringing IP Finance into focus

Director General Daren Tang, in his keynote opening, emphasized the rising significance of intangible assets in the global economy and called on financial actors to adapt. “Intangible assets are too valuable to overlook – and too powerful to be left on the sidelines,” he said, underlining a pivotal call to action. He underscored the systemic blind spot in financial reporting, saying “some of the most valuable assets in modern firms never appear on the balance sheet.”

Mr. Tang highlighted promising progress, noting IP-backed lending expansion in the UK, China, and South Korea. "It's like turning a telescope," he explained. "Suddenly what was blurry becomes clear." This sentiment resonated with Dr. Hajar El Haddaoui, Director General of Digital Cooperation Organization, who urged: "This is the moment to act and rethink how we define assets...to ensure we unlock capital for creators."

Financing the invisible economy

What makes IP finance so compelling? Its versatility across both debt and equity markets, according to the first panel. For venture capital, IP signals innovation quality and competitive advantage. "IP can be a strong signal for a company to prove its originality and its competitive moat," noted Ms. Iynna Halilou, Partner at The MBA Fund and lecturer on Venture Capital at HEC Paris, explaining how patent-owning startups are 6.4 times more likely to attract investment.

For lenders, these assets offer unique security. "IP assets are not assets that either a business or its investors willingly let go—that means they have tremendous behavioral influencing power," explained Mr. Martin Brassell, Co-founder and CEO of Inngot Limited. This compelling value proposition depends, however, on reliable valuation methods. Mr. Nicolas Konialidis, Technical Director at the International Valuation Standards Council, emphasized the nuanced expertise required: "Valuation is not a checklist. It is the application of sound professional judgment." This professional judgment builds confidence among financial institutions still unfamiliar with intangible assets. Mr. Rodrigo Ventura, Chief Economist of Brazil's National Institute of Industrial Property, complemented this by emphasizing the need for sustainable frameworks, particularly "clear valuation standards…as essential components for mainstream IP finance adoption.” Ms. Claudia Martinez Felix, Deputy Head of Unit for Intangible Economy at the European Commission, reinforced these perspectives: "IP protection signals credibility to investors, serving as an assurance and a validation of a novel idea, of protection of new products, new services."

Revealing hidden value

"The most valuable intangibles are those that... are not recognized on the face of the balance sheet," underlined Prof. Stefano Zambon from the University of Ferrara, who together with Prof. Laura Girella from the University of Modena and Reggio Emilia, presented preliminary findings from a forthcoming WIPO study on international disclosure practices. This disconnect stems partly from the fact that "accounting representation remains constrained by reporting models built for a pre-industrial and an industrial economy. The view that today’s standards could benefit from an overhaul to stay up to date with current developments is also shared by Mr. Tim Craig, Technical Director at the International Financial Reporting Standards (IFRS) Foundation, who explained: "The accounting standard for intangible assets might not be suitable now for companies operating in the digital age with many different types of intangible assets that might not have been envisaged when the standard was first developed."

The practical implications of this accounting blind spot were vividly illustrated by Mr. Ian Bishop, Head of Accounting at Roche, who described how analysts simply disregard reported intangible figures and insert their own valuations. Ms. Sandra Peters, Senior Head of Global Advocacy at the CFA Institute, added: "The challenge is that we can't break through this communication problem until we have better disclosures." Mr. Nova Chan, a Partner at PwC China, highlighted China’s efforts on that front, requiring IPO candidates to disclose detailed IP-related information in their prospectuses, which help foster a better understanding of these assets by market participants and the broader ecosystem.

Building trust through valuation

Moving from theory to practice, the third panel explored how professional valuation serves as a bridge between IP owners and financial institutions. Ms. Christine Ng, IP Valuation Director of Adastra IP in Malaysia, described growing interest from banks, who are now increasingly asking sophisticated questions about cost, expertise, reliability, and recovery aspects of IP valuation. She emphasized the need for standardized approaches that can work at both individual and portfolio levels. Mr. Peter Kaldos, an IP valuation specialist from Hungary, stressed that valuation professionals must adapt their services to financial institutions' needs rather than expecting lenders to navigate complex valuation methodologies.

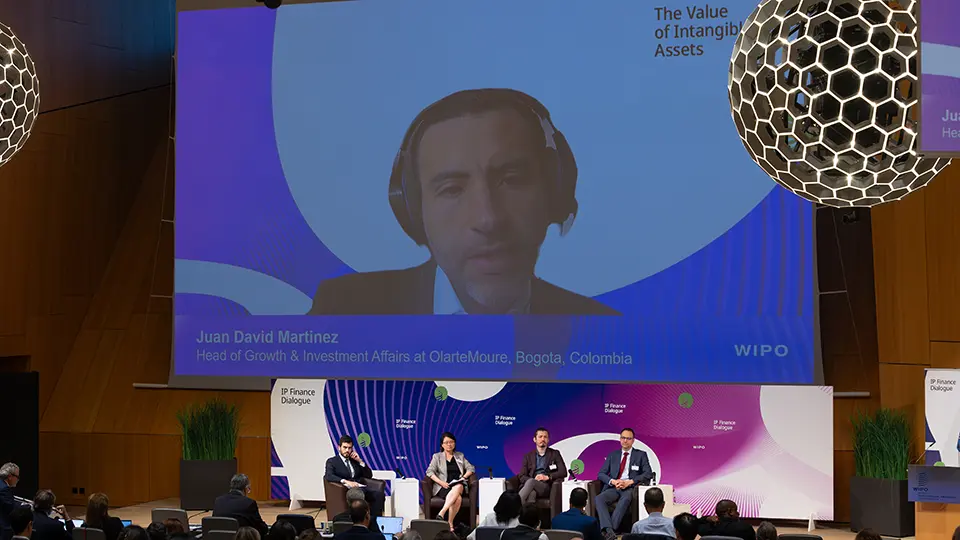

Technology is reshaping this landscape, with Mr. Mustafa Cakir, Co-founder of Patentiv and PatentEffect and a Board Member of the Licensing Executives Society (LES) in Türkiye, highlighting how valuation platforms powered by artificial intelligence (AI) are gaining traction particularly among startups. However, he cautioned that human judgment remains essential to the process. Mr. Juan David Martínez, Head of OMGrow and Investment Affairs at OlarteMoure in Colombia, emphasized that successful IP financing in emerging markets requires more than just strong IP assets—execution readiness, capable teams, and feasible market strategies play equally critical roles. These discussions underscored a central theme: building trust in valuation is as much about communication and understanding as it is about technical methodology.

From culture to capital

The final panel turned attention to the creative industries, where a remarkable investment trend is emerging. Prof. Christian Handke of Erasmus University Rotterdam presented findings from forthcoming WIPO research showing that over USD 20 billion has flowed into music rights and catalogue sales in just the last five to six years. "We have a very continuous revenue stream," he explained, noting that mature music catalogs provide predictable income similar to bonds. And even when looking at more volatile music rights, adding them to multi-asset portfolios can have positive diversification effects for investors and partially offset risks in other investments.

Beyond established markets, the panel explored extending financing models to emerging artists and cultural entrepreneurs. Mr. Roy Gitahi, Chairman of Art at Work Limited from Kenya, highlighted that young creatives lack traditional collateral, while Mr. Ivor Istuk, Senior Financial Sector Specialist at the World Bank identified three key policy approaches: "focusing on market infrastructure, financial sector policies, and de-risking to nudge the financial sector towards lending." These strategies, combined with building business skills among creatives, show how cultural expression can be transformed into economic opportunity worldwide.

Looking ahead: WIPO’s commitment to action

As the dialogue concluded, WIPO emphasized concrete actions to advance IP finance globally. The organization's Action Plan focuses on its practical approach to building bridges between IP owners, financial institutions, and investors through targeted resources and dedicated pilot projects. These initiatives aim to strengthen valuation expertise, create common language between stakeholders, and partner with lenders to test IP-backed financing in real-world conditions. Mr. Marco Alemán, Assistant Director General of WIPO, reinforced this commitment: "Unless we give intangible assets the place they deserve in today's economy, we cannot unlock their full potential."

You can watch the full IP Finance Dialogue and learn more about the IP Finance Dialogue and WIPO’s initiatives in IP finance.